How To Check My Business Credit Score Free? It’s crucial for understanding your financial health. In this article, discover how to check your business credit score for free. Monitoring your score regularly can help you make informed decisions and improve your financial standing. With the right tools and knowledge, staying on top of your business credit score doesn’t have to be a hassle.

How To Check My Business Credit Score Free

How To Check My Business Credit Score Free, there are a few key steps to follow. First, start by requesting a copy of your credit report from the major business credit bureaus like Dun & Bradstreet, Experian, or Equifax. Evaluate the report for any discrepancies or errors that could be affecting your score. Using online tools specifically designed for checking business credit scores can also help.

Some platforms offer free basic reports, while others may provide more comprehensive insights for a fee. Make sure to research and compare different options to find the best fit for your needs. Additionally, consider signing up for alerts that notify you of any changes to your credit score. This proactive approach can help you identify any issues early on and take steps to address them promptly. Another way to monitor your business credit score for free is to take advantage of any free trials offered by business credit monitoring services.

These trials can give you a snapshot of your current score and provide valuable information to help you understand your financial standing.

Understanding How To Check My Business Credit Score Free

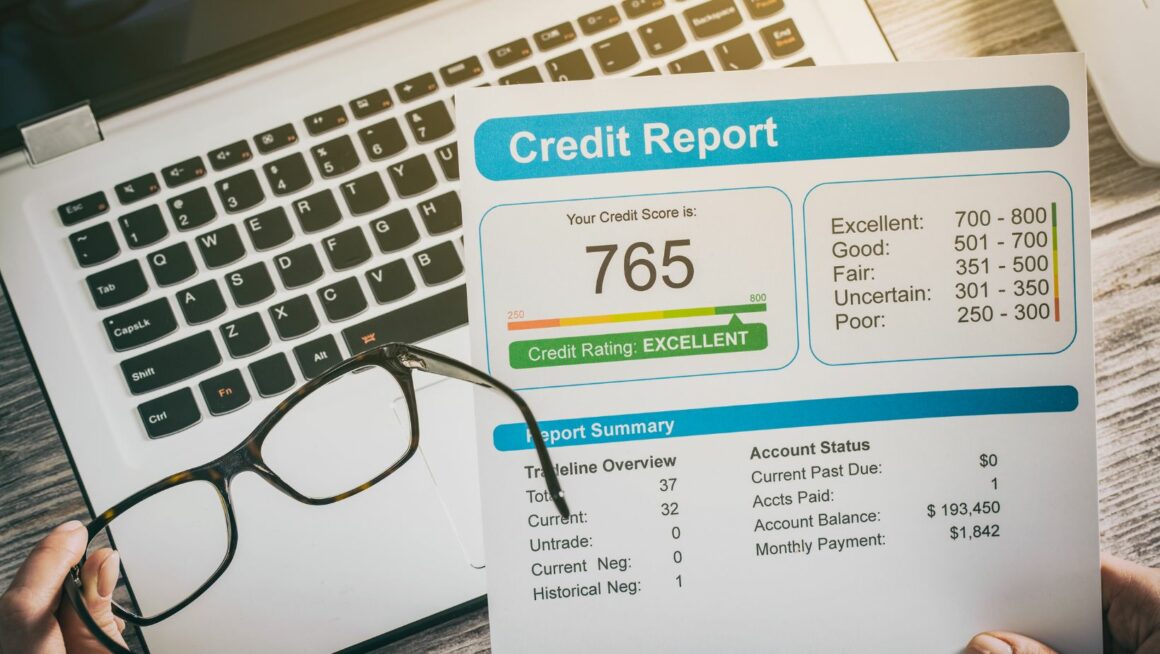

When it comes to business credit scores, it is essential for company owners to grasp the significance of this financial metric. Business credit scores are numerical representations of a business’s creditworthiness. They provide lenders and financial institutions with insights into the risk associated with extending credit or providing financing to a business. Business credit scores are typically calculated using various factors, including a business’s credit history, its payment records, credit utilization, and public records such as bankruptcies or liens.

Understanding these components can help business owners comprehend how lenders evaluate their creditworthiness. Monitoring your business credit score regularly can benefit your financial standing in several ways. By keeping track of your score, you can identify areas that need improvement and take corrective actions to enhance your credit profile. Moreover, a positive business credit score can increase your chances of securing favorable financing terms and competitive interest rates.

Importance of Monitoring Business Credit Score

Managing Financial Health

Regularly checking your business credit score is crucial for managing your financial health. It provides insight into your creditworthiness and helps you understand how potential lenders may perceive your business. By monitoring this score, you can identify any discrepancies early on and take corrective actions to maintain a positive financial standing.

Building Credibility with Lenders

A healthy business credit score is vital for building credibility with lenders. It demonstrates that your business is reliable and capable of managing its financial obligations. By keeping track of your credit score, you can ensure that you are well-positioned to secure favorable financing terms when needed. This proactive approach can help you establish strong relationships with lenders and access the funding necessary for your business’s growth.

Ways to Check Business Credit Score for Free

Utilizing Business Credit Bureaus

Business owners can check their business credit score for free by contacting business credit bureaus like Dun & Bradstreet, Experian, or Equifax. These bureaus offer free reports that provide insights into the creditworthiness of a business. By verifying the information and addressing any errors, businesses can ensure the accuracy of their credit profile.

Using Online Platforms

Another way to check business credit scores for free is through online platforms such as Credit Karma, Nav, or CreditSignal. These platforms offer convenient access to business credit reports and scores, allowing business owners to monitor their financial standing regularly. By staying informed about their credit health, businesses can take proactive steps to improve or maintain their credit scores.