For commercial property investors, energy has become one of the most volatile and difficult costs to manage. Grid prices continue to fluctuate, peak tariffs are rising, and tenants are increasingly sensitive to operating expenses. In this environment, protecting margins is no longer just about rent and occupancy — it is about energy strategy.

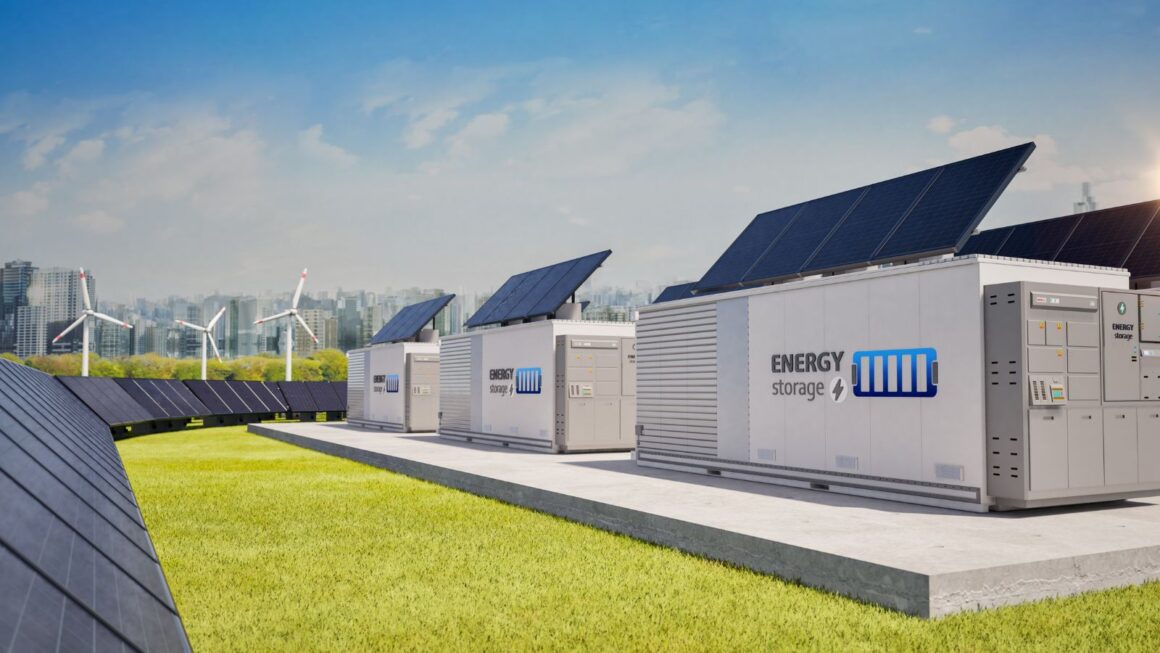

Solar generation has already proven its value for many commercial properties. In 2026, however, battery storage is emerging as the next logical step for investors looking to stabilise costs, improve resilience and protect long-term asset value.

The Cost-Control Challenge Facing Commercial Property

Energy costs have shifted from being a predictable overhead to a variable risk. Commercial buildings are exposed to peak pricing, demand charges and wider grid instability, all of which can undermine financial forecasting.

For landlords, this volatility creates pressure on both sides of the equation. Higher operating costs affect net yields, while tenants increasingly expect buildings to support lower and more predictable energy bills.

Battery storage addresses this challenge by allowing buildings to retain and deploy energy strategically rather than relying solely on real-time grid supply.

Why Solar Alone Is No Longer Enough

Solar panels generate power when conditions are right, but commercial energy demand does not always align with generation peaks. Without storage, excess solar energy is often exported back to the grid at relatively low rates, while buildings still rely on expensive grid electricity during peak periods.

Battery storage changes this dynamic. By capturing surplus generation and using it later, buildings increase self-consumption and reduce exposure to peak pricing.

From an investment perspective, this improves:

- The overall efficiency of the solar system

- The proportion of on-site energy used

- Long-term cost predictability

Battery Storage as an Asset Protection Tool

Battery systems are not just about savings; they are also about resilience. Grid outages, price spikes and supply constraints pose increasing risks to commercial operations.

Buildings equipped with solar and battery storage are better positioned to maintain continuity during disruptions. For certain tenants, particularly those reliant on technology or refrigeration, this resilience can be a deciding factor when choosing premises.

For investors, this translates into stronger tenant appeal and reduced vacancy risk.

Improving ROI Through Smarter Energy Use

Battery storage enhances the financial performance of solar installations by improving return on investment. Instead of exporting valuable energy, buildings retain it and deploy it when it has the highest economic impact.

Understanding options around commercial solar battery storage helps investors evaluate how storage capacity, system sizing and usage patterns influence payback periods and lifetime returns.

While batteries add upfront cost, they often improve overall project economics when assessed across the full system lifecycle rather than as a standalone expense.

Supporting Tenant Demand and Retention

Tenants are increasingly focused on energy efficiency and operating costs. Commercial properties that actively manage energy usage are more attractive to businesses seeking cost certainty and sustainability credentials.

Battery storage supports this by smoothing energy consumption and reducing exposure to peak tariffs. Over time, this can contribute to longer leases, stronger tenant relationships and reduced churn.

For multi-tenant properties, shared energy infrastructure can also become a differentiating feature in competitive markets.

Aligning with Sustainability and Compliance Goals

Sustainability considerations continue to shape commercial property investment decisions. Battery storage complements solar generation by maximising the use of renewable energy on site and reducing reliance on fossil-fuel-based grid power.

This supports carbon reduction goals and strengthens environmental performance metrics, which are increasingly relevant for investors, lenders and corporate tenants alike.

Importantly, sustainability improvements achieved through smarter energy systems often align directly with financial performance rather than competing with it.

A Long-Term View on Energy Strategy

The most successful commercial property investors are those who think beyond short-term savings. Battery storage should be viewed as part of a broader energy strategy that prioritises resilience, predictability and long-term value.

As energy markets remain uncertain, buildings that can generate, store and manage their own power are better positioned to withstand future shocks.

In 2026 and beyond, solar battery storage is no longer just a technical upgrade. For commercial property investors, it is a strategic tool for protecting assets, controlling costs and strengthening long-term returns.